Smart contracts are the next evolutionary stage for finance – but what happens when things go wrong? Can you sue over a self-executing contract?

Key Takeaways:

1. Are Smart Contracts legally binding?

It depends on contract formation, intent and jurisdiction, since both US and Canadian courts have ruled both for and against their enforceability.

3. What are the biggest risks?

Bugs, fraud, lack of dispute resolution and an unclear legal standing, since they are so new.

What is a Smart Contract?

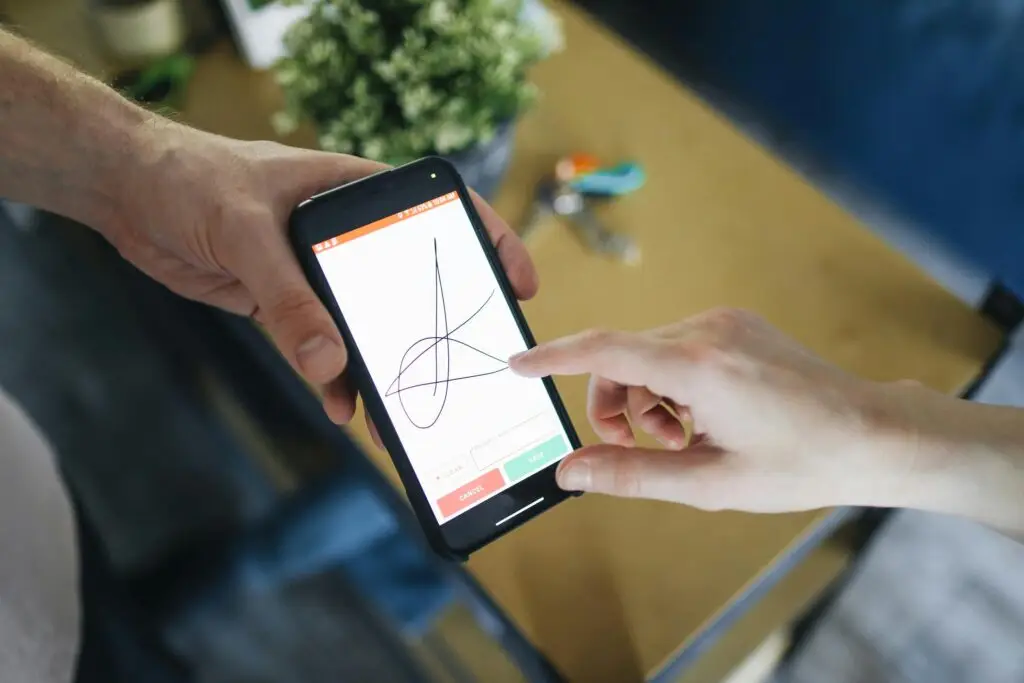

A Smart Contract, or SC, is a self-executing code that is stored on a blockchain. Originally platformed on Ethereum, it automatically enforces an agreement when pre-defined conditions are met. It can either be the sole manifestation of the agreement between the parties or might complement a traditional text-based contract and execute certain provisions, such as transferring funds from Party A to Party B.

For example: a Non Disclosure Agreement, or an NDA, can be a Smart Contract. Clearly, a the Smart COntract will be legally binding here.

Let’s say a tech startup frequently signs NDAs with employees and investors. A Smart NDA would automatically restrict access to confidential files. If an employee breaches the NDA (for example, they share confidential data), the smart contract triggers a penalty (for example, locks the access of the employee or triggers a fine to them).

Are Smart Contracts Legally Enforceable in the U.S. & Canada?

There is no federal recognition of Smart Contracts in United States and Canada. Rather, the enforceability and interpretation of contract is often determined at the state level, particularly for US. An example is the Arizona Bill HB 2417. The general recognition is that although two parties can enter into any form of an agreement, a contract means that the agreement is binding and enforceable in a court of law. And in order to determine if a contract is enforceable or not, the courts look at the basic requirement, i.e., whether the common law requirement of offer, acceptance and consideration are satisfied.

In the entirety of this discussion, we must not forget that the current laws that govern the electronic forms of contract, predate the development of blockchain technology.

However, in both US and Canada, and even Europe, the adoption of blockchain ecosystem is in full swing, with innovations like smart contracts and decentralized finance (DeFi) emerging at an accelerated pace. In Canada, currently, the common law requirements of a contract are being applied to electronic agreements as well. As a result, courts evaluate their enforceability on a case-by-case basis, considering factors such as contract intent, mutual agreement, and the nature of the transaction.

A credible harvard research on the potential and inherent limitation of a smart contract: Harvard Journal of Law and Technology.

Scenario Example:

Alice, a business owner in Vancouver, wants to hire Bob, a freelancer in Toronto, for website development. To ensure transparency, they use a smart contract on Ethereum for payment automation.

Step 1: Alice deploys a smart contract that states:

- If Bob submits the completed website code by March 30, 2024,

- The smart contract automatically releases 3 ETH from escrow.

This constitutes a clear offer with defined terms.

Step 2: Bob interacts with the smart contract by agreeing to its terms and submitting his wallet address. he blockchain records his digital acceptance.

This meets the common law requirement of acceptance since Bob voluntarily interacts with the contract.

Step 3: Bob delivers the website code, and the smart contract automatically verifies completion. 3 ETH is released to Bob from escrow.

The exchange of consideration has taken place.

Since no human intervention is needed to execute the transaction, the nature of the obligation (payment for work) is automatically enforced, making it legally binding under common law principles.

Biggest Challenges Faced by Businesses?

1. Legal and Regulatory Uncertainty: There is no recognition of Smart Contracts on a federal level, and the laws vary across states and provinces. Some US states such as Arizona and Nevada have updated their electronic transaction laws to include Smart Contracts, but federal courts remain quite cautious.

2. Bugs and Exploits: Vulnerabilities in code can be exploited by hackers which can lead to financial losses.

3. No Dispute Resolution: In traditional text based contracts, you can specify the governing law and the dispute resolution mechanisms. However, Smart Contracts execute automatically and on a global scale, leaving little room for interpretation.

Here’s a quick checklist on how to avoid lawsuit for businesses!

Conclusion: Are Smart Contracts the Future of Business?

Smart contracts offer automation, security, and efficiency, but businesses must take a strategic approach to ensure they are legally enforceable and protected from risks.

1. Hybrid Approach: Pair a Smart Contract with a tadeonal legal contract in order to ensure enforceability and address the potential issues with Smart Contracts, all in one go.

2. Audits: Conduct security vulnerability audits on Smart contracts in order to ensure no unseen bugs or code breaks are present.

3. Implement Dispute Resolution Mechanisms: Since Smart Contracts lack a built-in dispute resolution, you can integrate an on-chain arbitration using services like Kleros.

If you would like any legal, business or technology advice, please reach out here!

A quick intro to Smart Contracts: